|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding the Cost of Pitbull Insurance: A Comprehensive GuideWhen it comes to insuring a pitbull, a breed often surrounded by both admiration and controversy, many prospective pet owners find themselves asking, 'How much is pitbull insurance?' To tackle this query, it's imperative to delve into the factors influencing the cost, which can vary significantly based on numerous elements, including your location, the specific insurance provider, and the individual dog's history and characteristics. Insurance for pitbulls often tends to be more expensive compared to other breeds due to the perception of higher risk, whether founded or not, associated with this particular breed. Despite the stereotype, many pitbulls are loving and gentle companions, yet insurers frequently take into account the breed's public reputation, which can be linked to incidents that make headlines more often than for other dogs. To understand the specifics, we must consider the components that typically affect insurance premiums. Location plays a crucial role; in regions where pitbulls are considered a higher liability, the cost of insurance may reflect this through increased premiums. Furthermore, the insurer's policy towards pitbulls can vary dramatically; some companies may refuse to cover pitbulls altogether, while others might offer coverage at a premium. The individual dog's history is another significant factor-if a dog has a history of aggression, the insurance costs are likely to rise. Conversely, a pitbull with a well-documented history of good behavior and proper training might benefit from reduced premiums. Generally, the average cost of insuring a pitbull can range from $200 to $1,000 annually, but this range can stretch further based on the aforementioned factors. It's also vital to consider the type of coverage you need. Basic liability coverage, which covers incidents such as bites or property damage, tends to be less expensive than comprehensive plans that might cover health issues or more extensive liabilities.

Ultimately, when considering pitbull insurance, it's crucial to shop around, compare quotes, and consult with insurers to fully understand what each policy entails. It’s not just about finding the cheapest option but finding a policy that offers peace of mind and adequate coverage for both the pet and the owner. In conclusion, while insuring a pitbull can indeed be more expensive than other breeds, with careful research and consideration of available options, it is entirely possible to find a policy that balances cost with necessary protection. As a responsible pet owner, ensuring your pitbull is adequately covered is part of the commitment to their safety and well-being, as well as that of the community around them. https://www.nerdwallet.com/article/insurance/home-insurance-pit-bull

Dog Bite Insurance, Xinsurance and the Einhorn Insurance Agency are three agencies that may be able to help you find insurance for your pit bull ... https://www.pawlicy.com/dog-insurance/american-pit-bull-terrier-pet-insurance/

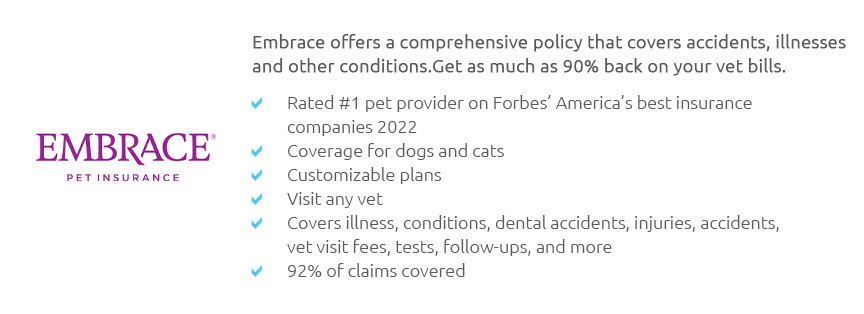

How much is pet insurance for a American Pit Bull Terrier puppy? ; New York City, NY. 6 Months Old - $54 to $90. 5 Years Old - $72 to $109 ; Thomasville, AL. 6 ... https://www.embracepetinsurance.com/breed/pit-bull-pet-insurance

Risk Factors and Costs for Common Pit Bull Health Issues ; Hip Dysplasia - $1,500-$6,000 ; Gastric Dilatation Volvulus (Bloat) - $1,500-$7,500 ; Deafness - $100-$300.

|